"The child’s father and mother were amazed at what was said about him; and Simeon blessed them and said to Mary his mother, 'Behold, this child is destined for the fall and rise of many in Israel, and to be a sign that will be opposed, and a sword will pierce your own soul, so that the thoughts of many hearts may be revealed.”

Luke 2:33-35

"When Jesus saw his mother, and the disciple whom he loved standing near, he said, 'Woman, behold, your son.' Then he said to his disciple, 'Behold, your mother.' And from that moment the disciple took her into his home."

John 19:26-27

"When they had seen him, they spread the word concerning what had been told them about this child, and all who heard it were amazed at what the shepherds said to them. And Mary treasured up all these things, and pondered them in her heart."

Luke 2:17-19

"And a great sign appeared in heaven: a woman clothed in the sun, with the moon under her feet and a crown of twelve stars on her head."

Revelation 12:1

“Simon, Simon, behold, Satan demanded to sift all of you like wheat. But I have prayed that your own faith may not fail. And once you have returned to faith, you must strengthen your brothers.”

Luke 22:31-32

The Dollar and VIX chopped sideways and were essentially unchanged.

The spokesmodels were talking up 'King Dollar' with pom-poms flashing. Sis boom bah.

Stocks declined quite a bit but came back from the selling pressure in the last half hour.

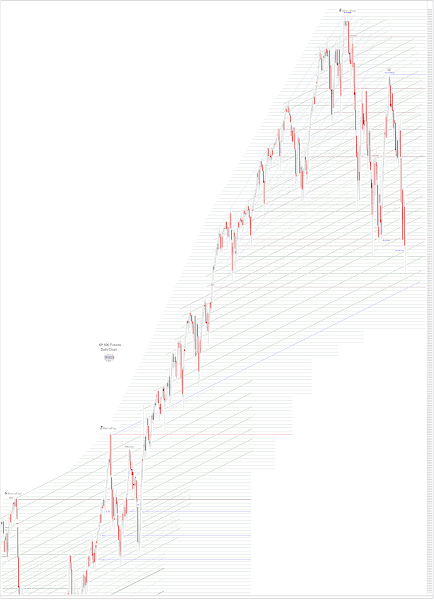

Gold and silver were slammed.

What a surprise.

Tomorrow must be a major stock option expiration and rebalancing, aka a 'quad witch.'

Lawless, with little to no consequences.

Fedex withdrew their 2023 earnings forecast in an early announcement after the bell and was knocked down 11%. Ouch.

Have a pleasant evening.