"We looked into the abyss if the gold price rose further. A further rise would have taken down one or several trading houses, which might have taken down all the rest in their wake. Therefore at any price, at any cost, the central banks had to quell the gold price, manage it. It was very difficult to get the gold price under control but we have now succeeded. The US Fed was very active in getting the gold price down. So was the U.K."

Edward 'Steady Eddie' George, Governor Bank of England 1993-2003, from Reg Howe v. BIS, JPM et al.

"The general hypothesis I have put forward over a period of time at this café is that with the spike in the price of gold up to $1900, the central banks of the West became greatly concerned, and opted for a lower price, and a more orderly rise. And so the price of gold was smacked down into a trading range between $1540 and $1780 through the various price and market operations of some central and bullion banks in what we can think of as a gold pool.

As you may recall, the great sea change was that central banks turned from being net sellers to net buyers of gold, slowly over a ten year period from 2000-2010 approximately. This change of policy was not uniform, but driven largely from the emerging and re-emerging nations. It ought not to surprise us. No fiat currency has survived for so long in historical terms, and even fewer as the world's reserve currency, unless backed by an unassailable empire. They will fall to Triffin's Dilemma, and the decay of power to self-serving and short-sighted corruption.

Forces similar to those that are working against the EU monetary union, without a comprehensive political union, are working against the dollar global reserve currency, on a much larger and slower paced scale. This is why a global currency issued and controlled by one central entity tends to presume (and aspire to) a one world governance, or at least a cohesive governance of a rather large piece of it. It is not incidental to their financial goals.

The gold pool can rehypothecate and leverage physical gold by multiples into paper, and outright create it with naked short selling. And they can sell this paper in bulk at whatever they wish in the markets which they control. And they can use positional advantage and their media to bully boy anyone who dares to question this into silence. But they cannot print gold bullion and deliver it to Asia (et al.), which quite frankly does not care what they say.

In general this is what is referred to at the divergence between the paper and physical gold markets. It is what happens when 'semi-official' forces endeavor to set an artificially low price in a market that involves some physical commodity which is in a somewhat limited supply. It tends to become more limited as a result.

But the supply of paper gold is not limited in the short term, especially where things like position limits and leverage are given the wink and a nod behind a wall of opaque obfuscation.

So this is why I think things will unravel in a manner similar to the London Gold Pool's operation which sought to set and maintain an artificially low price. How exactly this will unravel is a matter of much conjecture. I doubt it will break at the source of the paper gold, given the power the insiders have over the rules and information there. Rather, there is more likely to be a strain at some physical delivery source that will cause the current pool to back up the price higher to some more sustainable level. What that will be I cannot say.

What is driving this current dynamic is what is called the 'currency war,' which is shorthand for a difference of opinion amongst the world powers over the existing global currency trade regime."

Jesse, 22 January 2014

“Crime, once exposed, has no refuge but in audacity.”

Tacitus

"Nor can private counterparties restrict supplies of gold, another commodity whose derivatives are often traded over-the-counter, where central banks stand ready to lease gold in increasing quantities should the price rise."

Alan Greenspan, Congressional Testimony, July 24, 1998

Paper gold is a derivative, an often non-collateralized claim that may not be available from a counterparty in the present moment. In the NY-London markets gold is estimated to be traded at a leverage of over 100 to 1, with the individual paper chits called gold having a very ephemeral attachment to any underlying physical bullion, bearing a significant burden of unallocated risk.

As noted fund manager Kyle Bass observed, 'The [gold] exchange is a fractional reserve exchange, and they think that price will solve everything.'

By its very nature a fiat currency is a projection of political and economic force. And as it expands beyond reasonable bounds, confidence and volition may waver, and force and fraud and compulsion will increase.

False flags of war can be economic policy (too often a euphemism for greed and lust for power) as well as diplomacy by other means.

Sometimes when things are happening that don't seem to make sense, it may be a lack of a general understanding of the bigger picture, the players and the issues and motivations behind the scenes, that is the cause of our confusion.

And often normal, hard-working human beings are not able to fully comprehend the sort of petty vanity and greed that motivates the hubris of prominent servants of the darkness of the world.

Stocks were rallying for whatever rationale this morning after a fairly predictable consumer price dataset this morning.

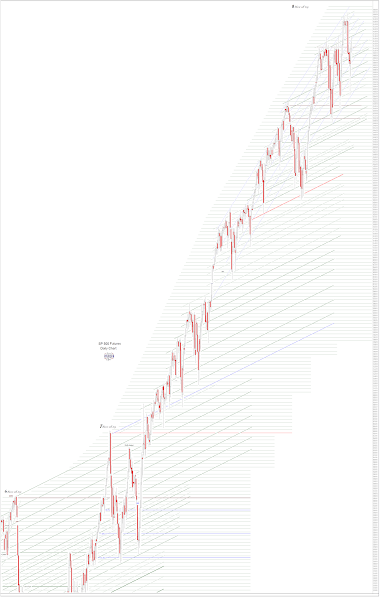

The Dollar plunged on the news as you can see from the first chart below.

Sometimes looking at things cross markets is the only way to see what is happening.

Producer price index tomorrow.

There are geopolitical flash points are the world, any of which could provoke a serious exogenous event effect on the world financial markets.

Some of this may be by intent. But most often it can be explained by pride, greed, and lack of foresight, which are often close companions in human political arenas and worldly affairs.

For we wrestle not against flesh and blood alone, but against principalities and powers, and the rulers of darkness of this world, and wickedness in high places.

Recklessly wicked and destructive things, which the normal human being finds it almost inconceivable to consider.

Have a pleasant evening.