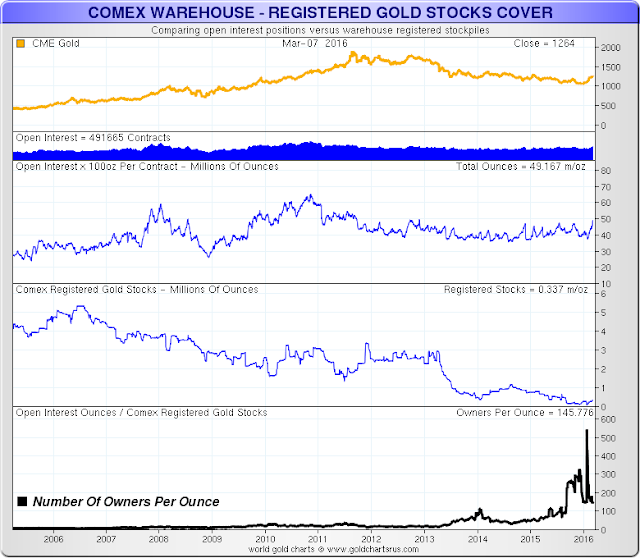

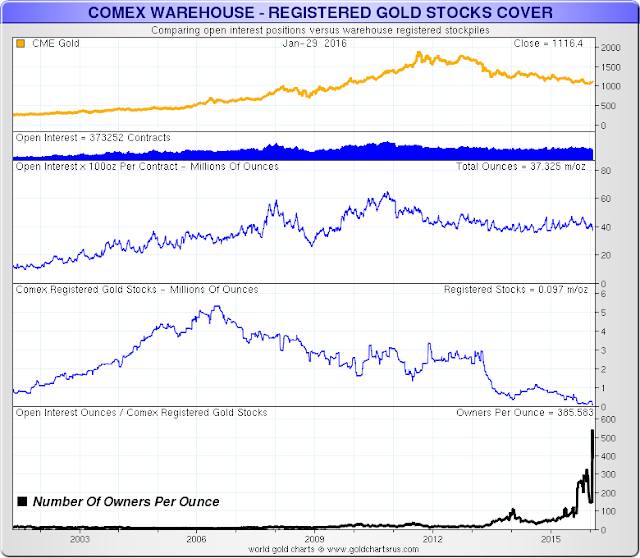

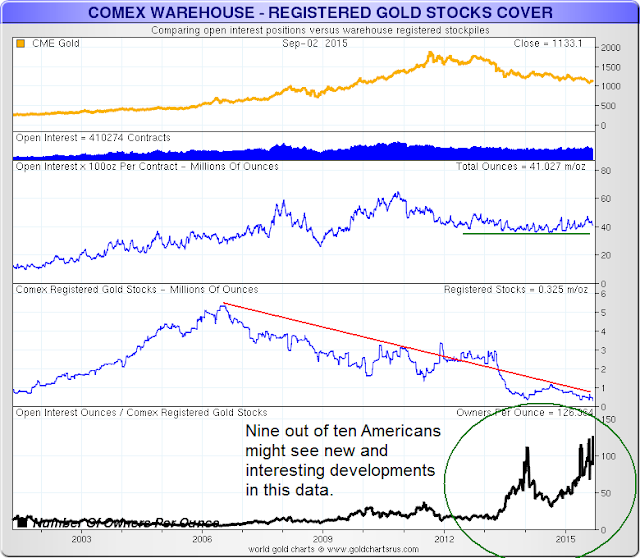

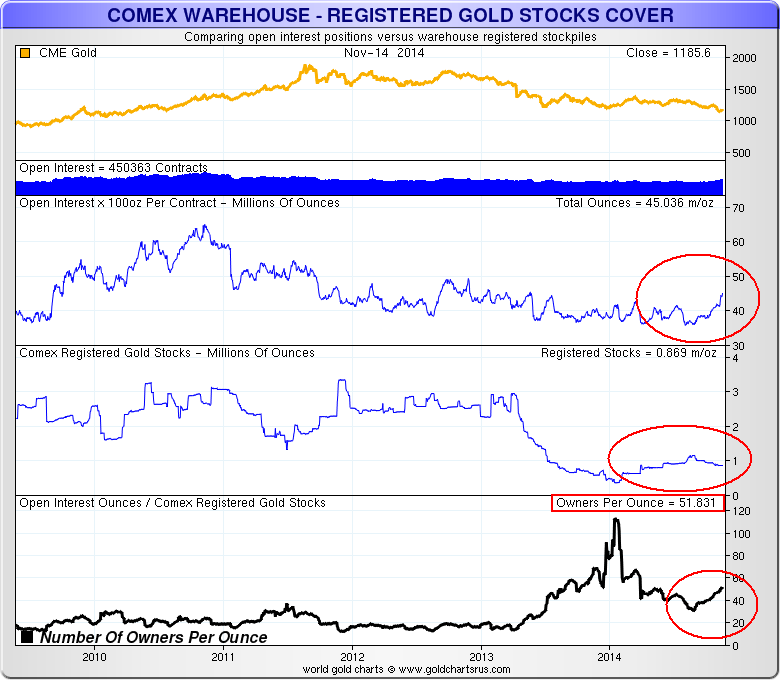

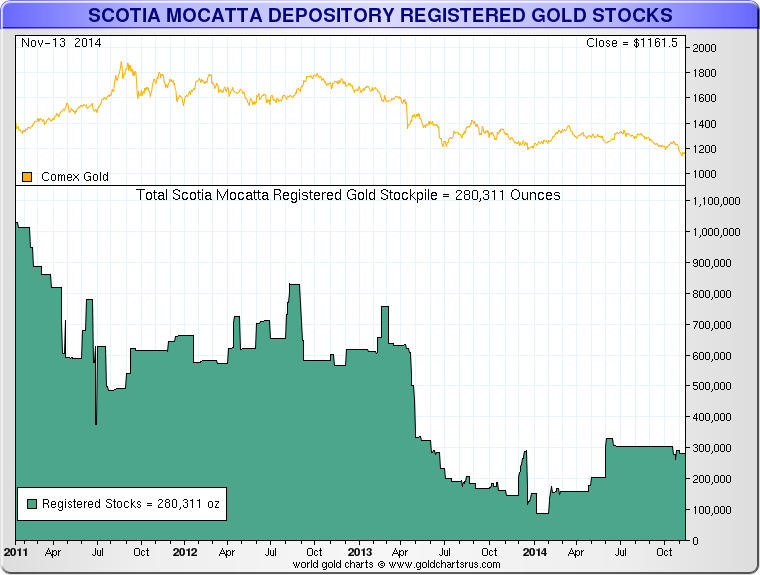

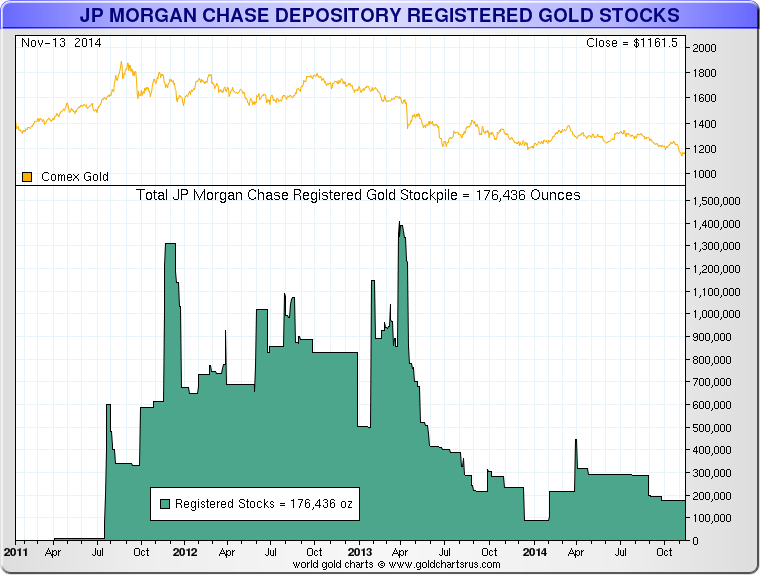

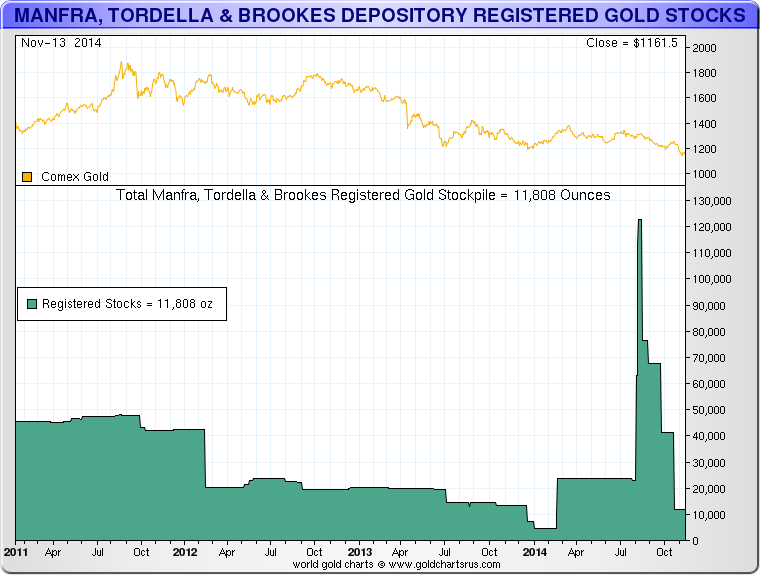

JP Morgan, who as I shared last month tends to move large amounts of gold into the registered (deliverable) category on the Comex just in the nick of time, took another huge tranche of gold out of that category last Friday.

Registered (deliverable) gold is now down 202,000 troy ounces or a little over 6 tonnes, a level which we have not seen there since Nick Laird started keeping track of the Comex warehouses in 2003.

A quick calculation that awaits the updated open interest figure shows that the 'claims per deliverable ounce' has now likely soared to over 200:1. We have never seen a ratio that high.

I will put up the 'official calculation' from Nick when the official number becomes available. We might not see the ratio climb if there has been a plunge in open interest, however unlikely that might seem.

Not just considering the Comex, which I consider to be a atavistic pricing mechanism, a conjunction of several things trouble me in the light of Ronan Manly's second article in his current series.

He does a meticulous estimate that indicates that the levels of

unencumbered gold in the LBMA, which some of us have come to call 'the float' of physical bullion, are now so low that he calls it 'a game of musical chairs' to cover the unallocated gold accounts.

You may read Ronan's entire article

here.

Things being what they are, I am now persuaded that 'the float' is tight enough so that the probability of a 'break' or dislocation in the physical bullion market is high enough to warrant some extra caution. Not panic, but caution, at least until the situation clarifies, particular with an eye to the historically significant month of December.

The other item that greatly concerned me is Jim Rickards assertion that in this type of situation the price of gold is not likely to go up gradually, but may suddenly rise step-wise, almost overnight, by more than a hundred dollars or so

per step. You may watch it

here.

I do not claim to have the contacts or pull that some may have or claim to have. But I have now seen enough to think that in terms of insurance and conservative investments that caution is warranted, now, rather than later.

So, IF you are an investor, not a short term trader, and are holding some percentage of gold in your portfolio as insurance, you may wish to reconsider any arrangements that you may have in which you cannot exercise reasonable control over your possession of bullion which you have purchased.

This is what I believe

Kyle Bass referred to as fiduciary caution.

Particularly at risk of a forced cash settlement would be any leveraged or unallocated holdings with an indeterminate counterparty risk, or what some people refer to as 'paper gold.'

I am

not saying that there will be a hard default, in terms of outright confiscation in a bankruptcy court, not at all. Although that may happen.

But I would consider carefully any arrangements that offer guarantees or assurances that could be satisfied with a cash settlement at a price to be determined by someone else without your consent. As we saw in 1933, they settled at one 'official price' and then allowed the price to resume some 40% higher.

If you are a short term trader, do what you will, but be mindful of your leverage, and take uncovered short positions at your own risk. And if covered, carefully consider your counterparty risks, because the bigger players will be lawyered up and looking for patsies and victims. Again, a hard lesson from MFGlobal.

This market may likely turn extremely volatile, even to the extent of a big down move followed by a sizable move higher. This is how these jokers roll. When the going gets tough, they tend to keep doubling down and running a bravura bluff. This was the story of 'the London Whale.'

In the meanwhile, we will have to bear up as best we can with this ridiculous lack of transparency and secrecy and sound regulatory oversight in public markets in the age of crony capitalism.

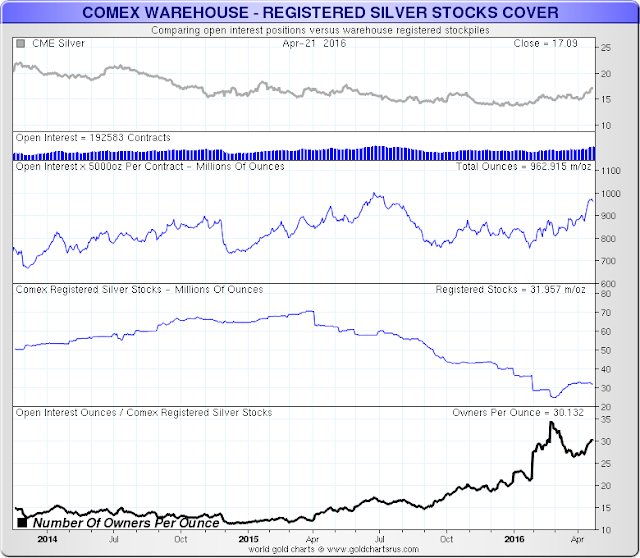

I have included the latest silver Comex chart as well. I have to admit that I do not feel I have the same grasp of silver that I hope to achieve in gold. There seems to be a steady bleed in the inventories, and one huge difference is that with silver there is no great central pool of it to cover short term gaps in the physical markets through leasing as there is with gold.

So, I will keep an eye on silver, because the premiums there are acting more oddly on the retail level than gold is, and its market structure is such that a festering problem can become a big and obtrusive problem rather quickly, and the central banks would be in a poor position to do anything about it.

I would tend to exercise the same caution with silver investments as insurance as I would with gold. And so I am.