"Switzerland’s central bank is flexing its muscles to defend its cap on the Swiss franc. Its battle to fend off deflation – in which it sees the exchange rate as its chief weapon – is already complicated by the slide in the euro that followed European Central Bank easing.

Now the SNB is fighting on a new front: to block a populist motion that would force it to almost treble the proportion of reserves held in gold."

Financial Times - Swiss National Bank Fights To Block the Public Gold Vote

Crushing populist notions seems to be quite fashionable amongst the better classes of the West. Unless of course those notions are taking place somewhere else that has fallen out of their favor. Then they are all for

democracy don't you know.

Sometimes I just don't have the words. To watch the proud Scots go down to fear-mongering by the financial establishment and their pampered princes is bad enough. But to hear that this may also happen to the Swiss people whether or not they believe in the Banksters makes me sick at heart.

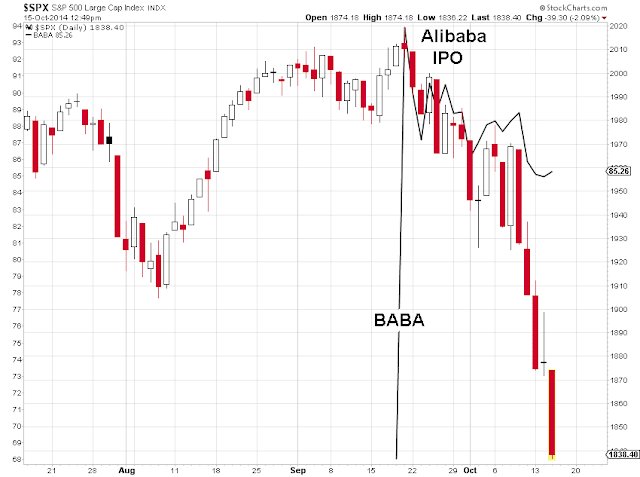

Gold and to a lesser extent silver caught a flight to safety bid today as US equities were in full meltdown mode this morning on bad economic news that accentuates that, despite all the facades and window dressing, there is no sustainable recovery.

I have to chuckle at the Fed choosing to end QE3 in October. As I recall, that last two times the Fed ended QE the equity markets dropped about ten to fifteen percent.

And so we have the US equity markets, which had been pushed to an obvious artificial high for the year to date by the usual Banks trying to get the largest IPO

ever out the door in September.

And the Fed sticks to their plan to end QE 3 in October, an infamously volatile month for stocks. Why didn't they just choose October 29 for the official end date, and call it the Black Wednesday Stock Declines Initiative?

Well there is still some short term hope for the stock markets because this is a stock option expiration and the algos are able to shove this pig around the plate when the panic subsides, as we have seen. One thing you have to give Wall Street: they are not too lazy to steal.

Fundamental analysis is passé, and we are operating in a fiat culture: whatever power decrees must be true. And it is not likely that you will hear otherwise, except in conversations in the coffee houses and cafes.

Have a pleasant evening.